bain capital tech opportunities fund ii lp

Bain Capital Credit Ltd. Bain Capital Fund XII LP.

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Bain Capitals second Tech Opportunities fund is targeting 15 billion for investments in mid-market buyouts and late-stage growth for control and minority transactions.

. Tech Opportunities Fund I closed 11B. Ad Calverts strategic approach Is built on deep industry-specific research. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping up the strategys debut fund with 125.

Jay Corrigan Managing Director Global Private Markets Finance. We combine deep domain expertise with the ability to tap the global reach insight and relationships of the broader Bain Capital platform across the entire technology ecosystem. Credit Opportunities II COPs II holds final close.

Bain Capital Tech Opportunities pursues investments in application software fintech and payments healthcare IT and infrastructure security. Bain Capital which manages more than 100 billion is planning to raise 1 billion for a tech-focused fund that will invest in takeovers and late-stage minority investments. Bain Capital Tech Opportunities Fund secured 107 billion according to a regulatory documentIt is now ahead of its 1 billion target reported last.

Bain Capital LP is one of the worlds leading private multi-asset alternative. The Bain Capital Public Equity team invests globally across the major industry verticals applying deep domain expertise and a differentiated perspective to source unique opportunities. Since our founding in 1984 weve applied our insight and experience to organically expand into.

Bain Capital Fund VI in 1998 was the last one Romney was involved in. Inception of Bain Capital Senior Loan Fund LP SLF March 2009 Opening of New York office. Bain Capital Tech Opportunities Fund II LP according to David Lee the director of private equity for the council which manages 34 billion of assets.

Bain Capital Life Sciences pursues investments in pharmaceutical biotechnology medical device diagnostic and life science tool companies across the globe. Bain capital tech opportunities fund ii lp Tuesday February 22 2022 Edit. Bain Capital Tech Opportunities Fund secured 107 billion according to a Form D fundraising document.

While Bain Capital appears to have met the target for its new technology offering the firm has not yet held a final close according to person with knowledge of the matter as as reported by sister title Buyouts. Katie Czerepak Head of Talent Portfolio. Credit Opportunities II COPs II holds final close.

Our team of investment professionals combined with dedicated portfolio support blends the Bain Capital and impact investing experience to focus on driving value at our portfolio companies. The Korea Fund Inc. 23 2021 708 pm ET.

Read Full Story. Bain Capital Tech Opportunities Fund LP. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year after wrapping up the strategys debut fund with 125 billion.

While Bain Capital appears to have met the target for its new technology offering the firm has not yet held a final close a person with knowledge of the matter told Buyouts. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15 billion barely a year.

Fund II will focus primarily on North American. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. Since our founding in 1984 weve applied our insight and experience to organically expand into.

The Korean equity market was range. We combine deep domain expertise with the. November 24 2021.

Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under. Portfolio Managers Report December 31 2018 unaudited During the six-month period from July 1 2018 to December 31 2018 The Korea Fund Incs the Fund benchmark the MSCI Korea 2550 Index Total Return fell by -1189 in Korean Won terms and -1200 in US. Our team draws upon individuals with senior experience in both the life science industry as well as public and private healthcare investing.

Andrew Cleverdon Chief Financial Officer Senior Vice President Ventures and Tech Opportunities. Bain Capital is back with its second tech-focused fund that looks for opportunities in the red-hot sector. Bain Capital is pitching investors on its second technology-focused fund with a goal of raising 15.

Managing DirectorGeneral Counsel of GP of Issuers GP. BC Tech Opportunities Private Investors LP. Managing DirectorGeneral Counsel of GP of Issuers GP.

Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live. Fund 2021 raised 825M MARCH 1987. Headquarters at 200 Clarendon Street.

Kristen Deftos Senior Vice. Company CIK State Incorporated. It is now ahead of its 1 billion target reported last October by Buyouts.

Since our founding in 1984 weve applied our insight and experience to organically expand into several asset classes. Bain Capital CR LP. Bain Capital LP is one of the worlds leading private multi-asset alternative investment firms with approximately 160 billion of assets under management that creates lasting impact for our investors teams businesses and the communities in which we live.

Proven deep diligence value-added approach to build great mission-driven companies that deliver both competitive financial returns and measurable social. Bain Capital Tech Opportunities was created in 2019 to make investments in technology companies particularly in enterprise software and cybersecurity.

Athenahealth Acquired By Hellman Friedman And Bain Capital Private Equity Insights

.png)

About Us Bain Capital Private Equity

Bain Capital Targets 1 5 Billion For Second Tech Opportunities Fund Mint

Bain Capital Targets 1 5bn For Second Tech Opportunities Fund Private Equity Insights

When I Work Secures 200 Million Growth Investment From Bain Capital Tech Opportunities Bain Capital

Bain Capital Tech Opportunities Crunchbase Investor Profile Investments

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

Industries Bain Capital Private Equity

About Us Bain Capital Private Equity

Axtria Secures 150 Million Growth Investment From Bain Capital Tech Opportunities

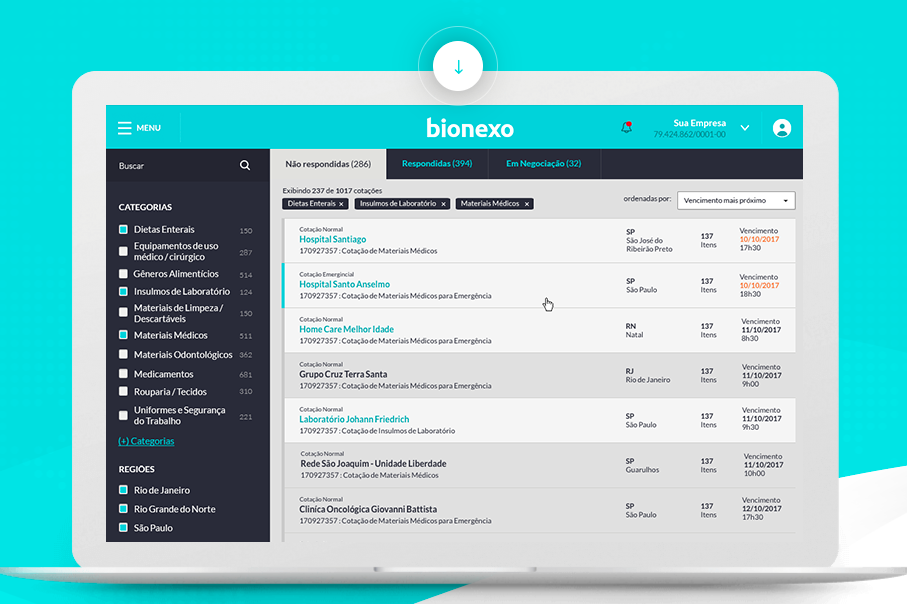

Bionexo Announces R 450 Million Investment From Bain Capital Tech Opportunities Bain Capital

Bain Capital Private Equity Current And Former Portfolio Companies Bain Capital Private Equity

Our People Bain Capital Tech Opportunities

Bain Capital Hits Target For Tech Fund With Nearly 1 1bn Plans To Keep Raising Buyouts

Our People Bain Capital Tech Opportunities

Pe Fundraising Scorecard Aea Bain Capital General Atlantic L Squared

Bain Capital S New Technology Fund Makes Maiden Investment Wsj